Achieving Sustainability

How investors could make a positive impact with private credit

Impact private credit may offer attractive opportunities for institutional and professional investors looking to combine financial returns with a positive environmental and social contribution. At Allianz Global Investors (AllianzGI), private credit specialists and impact experts work hand in hand to achieve this.

How is impact private credit different from private credit?

Impact private credit is, simply put, private credit that makes a measurable positive impact.

AllianzGI, the asset management arm of German insurance behemoth Allianz, defines impact investing as intentionally targeting positive and measurable environmental and/or social outcomes, while generating market financial returns. AllianzGI aims to do this by investing in companies which produce goods and services that offer solutions to the main environmental and social problems the world faces.

As such, adding an impact lens to investment opportunities does not alter what investors can expect financially, says Ricardo Cavilliotti, portfolio manager for impact private credit at AllianzGI.

Impact investment is beginning to be discussed more in the pensions industry, including in the context of the Local Government Pension Scheme and government ambitions to have it invest in ‘levelling up’ opportunities. A June report by the Global Impact Investing Network shows that in 2022, investment managers raised 20%, the largest proportion of impact capital raised, from pension funds. (Hand, D., Sunderji, S., Pardo, N. (2023) 2023 GIINsight: Impact Investing Allocations, Activity & Performance. The Global Impact Investing Network (GIIN). New York.)

However, there is still much confusion about terminology, including understanding the difference between impact investing and the integration of environmental, social and governance (ESG) factors into investing, says Diane Mak, AllianzGI’s Head of Impact Strategy.

“Impact is really the handprint of a company – the positive, measurable, significant contribution of a company’s own business model via the products and services it delivers.”

“If we’re talking about positive contribution and handprint and impact, we might be investing for example in a company that provides smart building and energy efficiency solutions to its real estate customers, which enable its customers to reduce the footprint of their buildings,” she explains.

In contrast, ESG is about the operational and conduct improvements of the company itself, such as reducing the company’s own carbon emissions footprint, rather than what it means for the customers of the firm.

“The solutions focus, positive contribution element of a company’s business model is really the difference in terms of impact investing versus ESG integration.”

How do you measure impact?

Measuring a positive contribution is not always straightforward, particularly in private markets, where data is not yet as standardised as in public markets.

At AllianzGI, measurement starts with the due diligence of the investee company, involving experts from both the private credit and the impact investing team. The latter will identify key impact performance indicators that are feasible and measurable, working with the company to embed this in the investment documentation so that the reporting requirements are met.

It is sometimes necessary to support firms to finesse their impact measurement and management capabilities, as some of the companies will not have any measurement and data gathering systems in place which we need in order to be able to properly assess the real-world impact of the company’s activities.

“It’s always going to be a learning and ramp up process, especially in the earlier days of investment.”

AllianzGI scores an investee company both in terms of impact based on the goods and services, and in terms of the investor contribution to help the firm succeed in impact generation. These two scoring components are presented to the investment committee as an overall impact score. The asset manager’s specialists then monitor, track and analyse the data coming from portfolio companies. They can aggregate this in an impact data management system and ‘slice’ data across portfolio company levels and sector levels.

The collection and analysis of impact data helps to understand the impact performance and to engage in a more effective way, either because of impact underperformance or because a company is outperforming and AllianzGI wants to know why – for example, checking whether the targets were off, or if the company is “just doing something really right”, explains Mak.

Where underperformance is identified, the team engages with the company to get Key Performance Indicators (KPIs) back on track, from the credit as well as from the impact perspective; often, the two aspects move in tandem for companies with impact at the core of their business models.

International frameworks provide standards

When the KPIs are set, the firm maps these to the United Nations’ Sustainable Development Goals, which serve as “the north star” for many impact investors, notes Mak.

Another leading industry framework which the team uses and which is embedded into AllianzGI’s impact scoring system, is the Impact Management Project’s ‘Five Dimensions of Impact’, which are:

- What – what outcome the enterprise is contributing to, whether it is positive or negative, and how important the outcome is to stakeholders.

- Who – which stakeholders are experiencing the outcome and how underserved they are in relation to the outcome.

- How much – how many stakeholders experienced the outcome, what degree of change they experienced, and how long they experienced the outcome for.

- Contribution – whether an enterprise’s and/or investor’s efforts resulted in outcomes that were likely better than what would have occurred otherwise.

- Risk – the likelihood that impact will be different than expected.

The AllianzGI team also uses the IRIS+ metrics framework. The use of these recognised frameworks helps managers to standardise definitions, and investors to report on their impact to stakeholders.

Are some companies better suited for impact private credit than others?

AllianzGI’s impact private credit strategy targets both environmental and social impact. In reality, being focussed on Europe, they are currently more on the environmental than the social side, says Cavilliotti, and explains that this is less to do with investor demand – although there is an element of that – but with the type of companies that operate in Europe.

“From an origination or sourcing standpoint, you tend to find more businesses on the environmental side. This is also a function of whether you’re investing in developed markets or emerging markets; usually in emerging markets, you will tend to see more investments with social impact,” he explains.

Mak highlights that environmental and social issues are often interlinked, for example in the access to affordable and clean energy, adding:

“There’s recognition that there is huge social inequality, both in developed and in emerging markets. So, alongside the need to urgently address climate change, we also need to ensure those who are underserved are not left further behind.”

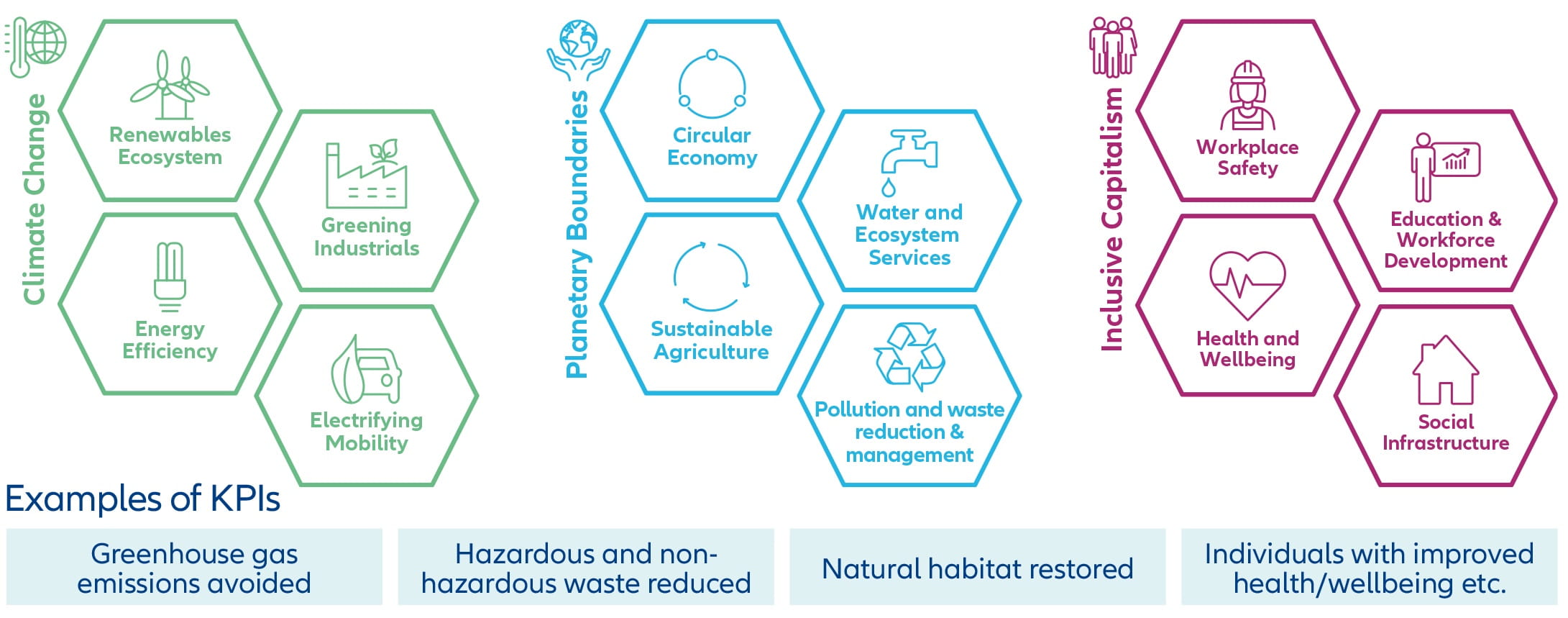

AllianzGI looks at impact through three lenses, which cut across social and climate impact and are designed to tackle some of the key challenges that the planet and society currently face:

- climate change;

- planetary boundaries; and

- inclusive capitalism.

Examples of Impact investment themes

For illustrative purposes only.

Multiple industries fit into these themes, says Cavilliotti. For example, the climate change theme includes renewable energy, sustainable transport and energy efficiency, while ‘planetary boundaries’ includes waste management companies and businesses promoting a circular economy. Workforce development, and healthcare and wellbeingrelated businesses, sit under inclusive capitalism.

“So even though at AllianzGI, we follow a sector-agnostic approach in our product credit investment strategy, the businesses within these sectors tend to be quite well positioned to tackle some of these challenges that we see,” he believes.

Examples of businesses include companies that provide solutions for businesses to significantly reduce energy consumption, resulting in lower carbon emissions, and manufacturers that produce and deliver agricultural irrigation products that help its customers reduce water consumption while improving crop yields. On the social side, there are vocational education training providers that mainly offer courses to people without any academic qualifications.

“Going back to the previous point about whether there’s a trade-off between impact and returns – as you see these are all examples of profitable businesses with growth potential, so we do not have to trade-off the two.”

Generally speaking, AllianzGI’s impact private credit strategy targets lower mid-market companies with earnings before interest, taxes, depreciation and amortisation of €5m to €15m – headquartered mainly in Europe, while keeping a small pocket up to 20% to potentially invest in OECD countries outside Europe. Companies’ products go beyond these limits, however, as they can be distributed across OECD countries as well as emerging markets.

Private credit is an illiquid asset class, and so investors must be prepared to lock money up for about seven to ten years and see the capital distribution come in over roughly five to ten years, depending on the strategy.

AllianzGI is currently targeting a return equivalent to Euribor plus 600 to 800 basis points; this could, with Euribor at 3% to 3.5% and some fees, mean a return in the range of 11% to 12% in today’s market conditions, depending on the strategy and the direction of Euribor, says Cavilliotti.

What should trustees consider before investing in impact private credit?

The definitions of impact can vary, so for pension trustees mulling a first allocation to impact private credit, one of the first things to look at is the impact definition that a given asset manager uses, says Cavilliotti, making sure that it aligns with that of the pension scheme.

Investors should satisfy themselves that the manager’s definition is backed by a robust impact approach and methodology, internal processes and ideally with a strong impact management team that works closely together with the private credit investment team, he advises.

“This is something we do at AllianzGI, our impact private credit strategy is a joint venture between the Impact and Development Credit team and the Impact Measurement & Management team which Diane heads.”

“Also, it’s important to understand what type of investment strategy within private credit better adjusts to each investor’s needs and preferences, as private credit is a very broad term,” he adds.