Infrastructure equity/debt investments are illiquid and designed for investors pursuing a long-term investment strategy only, and therefore might not be suitable for retail investors that are unable to sustain such a long-term and illiquid commitment. This website is for information purposes only. It does not contain all information necessary to allow potential investors to take an investment decision. It does not constitute an offer or an invitation to subscribe for interests, units or shares of an Alternative Investment Fund. The information presented herein should not be relied upon, since it is not final, incomplete and may be subject to change.

This is a marketing communication. Please refer to the prospectus of the AIF before making any final investment decisions.

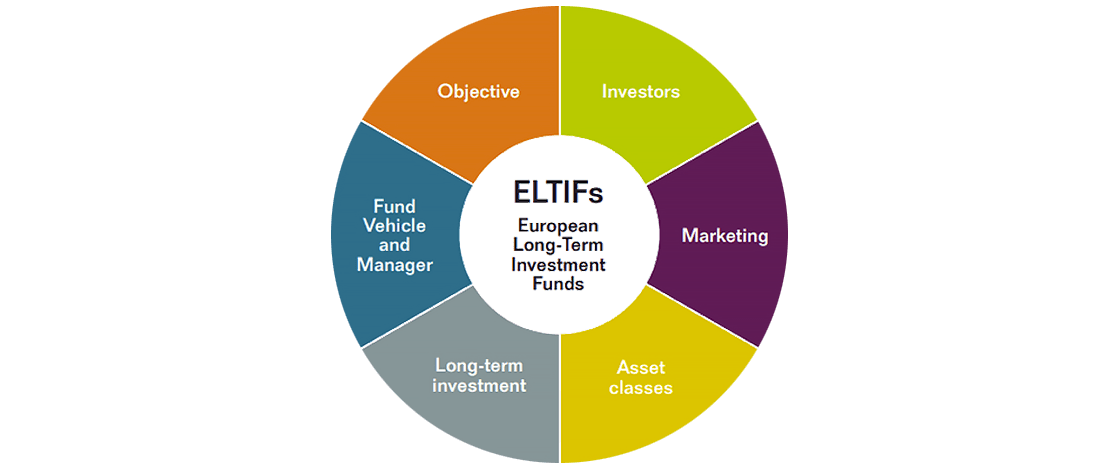

Investing and Asset classes

• Institutional investors

• Other professional investors

• Retail investors

Where the ELTIF is offered to retail investors, additional requirements apply. In particular, a product governance process needs to be implemented and suitability requirements must be met.

EU/EEA cross-border distribution passport

Mix of long-term assets and liquid assets

– exposures to qualifying portfolio undertakings including equity, quasi-equity, debt and loans

– real assets

– units or shares of one or several other alternative investment funds (AIFs)

– certain securitisations

– green bonds

ELTIFs may also invest in eligible assets for Undertakings for Collective Investment in Transferable Securities (UCITS) such as equities, bonds and other UCITS.

At least 55% of the capital

Regulated fund vehicle and manager

A financial vehicle

Source: Association of the Luxembourg Fund Industry (ALFI), ELTIF 2.0 – the European long-term investment fund (ELTIF), What is an ELTIF,

page 4. November 2023

This investment strategy is recommended only for investors who have a long-term investment horizon or who do not have substantial short-term liquidity needs.

Source: Allianz Capital Partners, 2024 based on its own research of the applicable regulatory environment.

1 ELTIF 2.0 is Regulation (EU) 2023/606 of 15 March 2023 amending Regulation (EU) 2015/760 (ELTIF 1.0) and applicable since 10 January 2024: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32023R0606

2 Figures in USD. Source: Global Infrastructure Outlook, accessed in March 2024 via Global Infrastructure Hub https://outlook.gihub.org/; numbers may not sum due to rounding. Differentiating between Rail, Roads, Ports and Airports (jointly “Transport”), Energy, Telecommunications (“Communication”), and Water infrastructure.

3 Allianz Capital Partners, 2024.

3 IPE Real Assets, AGI ranked 7th. in the Infrastructure Investment Managers Ranking 2023, Top 100 infrastructure investment managers 2023 | Magazine | Real Assets (ipe.com).

4 Data as of 31 December 2023, unless otherwise noted. The information above is provided for illustrative purposes only and transactions identified are not intended to be, and should not be interpreted as an offer, solicitation or recommendation to purchase or sell any financial instrument, an indication that the purchase of such securities or instruments was or will be profitable, or representative of the composition or performance of your account. The transactions identified do not represent all securities purchased, sold or recommended for client accounts. See additional disclosure at the end of this presentation. The positions of transactions on this map are approximate and are not an exhaustive illustration of all investments made.

Source: Allianz Capital Partners, 2024. A performance of the strategy is not guaranteed and losses remain possible.

5 IPE Real Assets, AGI ranked 7th. in the Infrastructure Investment Managers Ranking 2023, Top 100 infrastructure investment managers 2023 | Magazine | Real Assets (ipe.com).

6 Quarterly liquidity subject to restrictions and gating, see term sheet for details.

7 The fund aims to disclose under Article 8 SFDR: EU Sustainable Finance Disclosure Regulation. A fund is not yet in existence and any fund-related documents are not yet in final form. There can be no assurance the fund will be able to implement all its investment strategy characteristics or achieve its investment objectives or that investors will receive a return on their capital.

Source: Allianz Capital Partners, 2024.

8 ACP infrastructure funds & co-investments portfolio gross IRR in EUR after management and performance fees payable to external GPs but before ACP costs, investor taxes and allocable expenses at Allianz Investor level (per Q4 2023).

9 Correlation between private infrastructure equity and the MSCI World equities, expected on average over the next 10 years, based on estimates of the risklab Capital Markets Model as of 31 December 2023.

-

Infrastructure equity/debt investments are illiquid and designed for investors pursuing a long-term investment strategy only.

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested.

Past performance does not predict future returns. If the currency in which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer companies at the time of publication. The data used is derived from various sources and assumed to be correct and reliable at the time of publication.

For investors in Europe (excluding Switzerland and the United Kingdom):

This is a pre-marketing communication issued by Allianz Global Investors GmbH, www.allianzgi.com(opens in a new tab), an investment company with limited liability, incorporated in Germany, with its registered office at Bockenheimer Landstrasse 42-44, 60323 Frankfurt/M, registered with the local court Frankfurt/M under HRB 9340, authorised by Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de(opens in a new tab)). Allianz Global Investors GmbH has established branches in France, Italy, Spain, Luxembourg, Sweden, Belgium and the Netherlands. Contact details and information on the local regulation are available here (www.allianzgi.com/Info(opens in a new tab)). The Summary of Investor Rights is available in English, French, German, Italian and Spanish at https://regulatory.allianzgi.com/en/investors-rights(opens in a new tab).For investors in Switzerland:

This is a pre-marketing communication issued by Allianz Global Investors (Schweiz) AG, a 100% subsidiary of Allianz Global Investors GmbH.For investors in the United Kingdom:

This is a pre-marketing communication issued by Allianz Global Investors UK Limited, 199 Bishopsgate, London, EC2M 3TY, www.allianzglobalinvestors.co.uk(opens in a new tab). Allianz Global Investors UK Limited, company number 11516839, is authorised and regulated by the Financial Conduct Authority. Details about the extent of our regulation are available from us on request and on the Financial Conduct Authority’s website (www.fca.org.uk(opens in a new tab)). The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors UK Limited.This information contained herein is solely for educational purposes and should not be relied upon as a forecast, research or investment advice and is not a recommendation to adopt any investment strategy.

May 2024 | AdMaster 3594294