Samenvatting

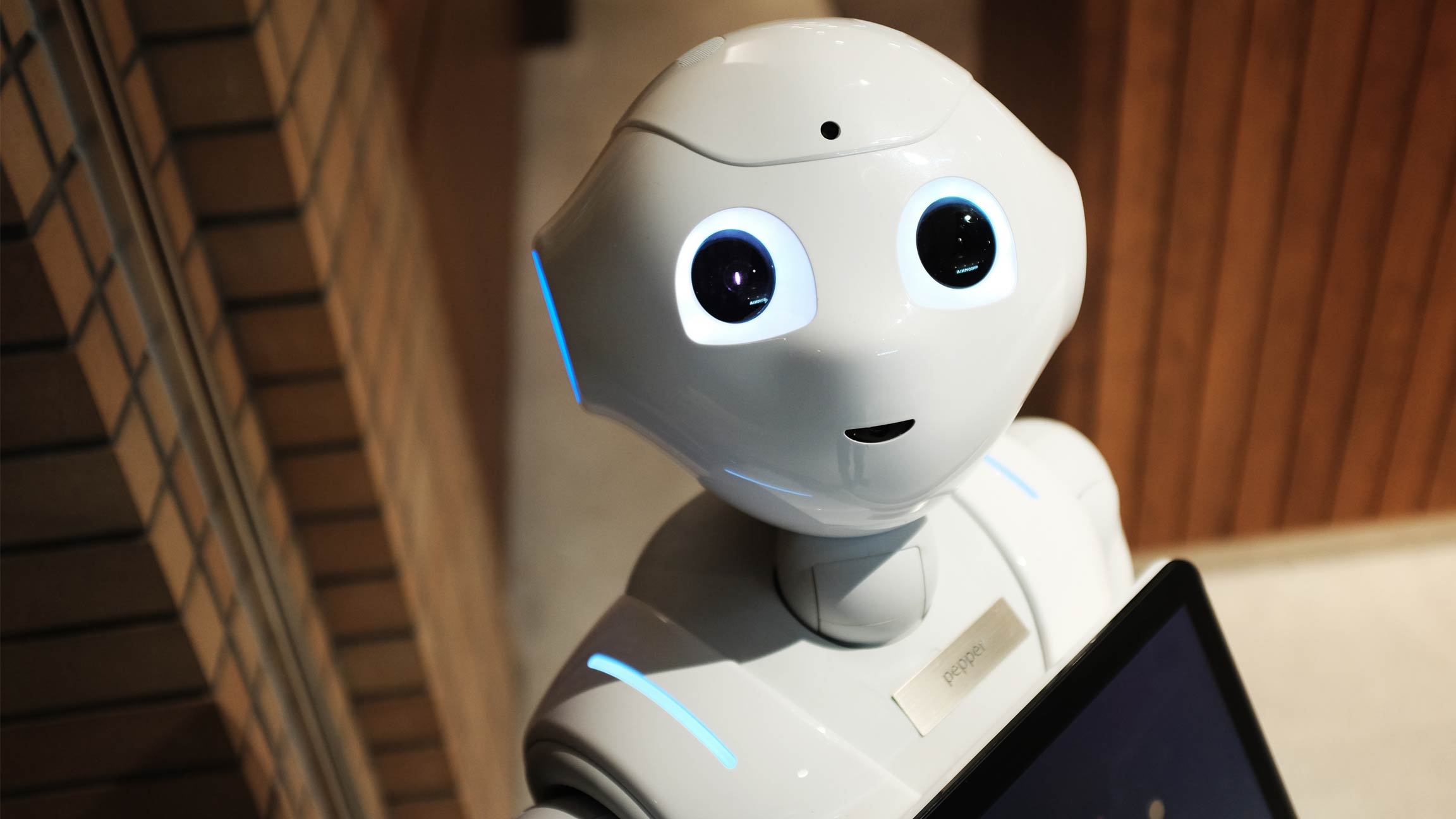

A new study featuring financial advisors in the US shows that they do not consider robo-advisors a serious threat, and most do not expect to make changes to their business to address them. Only a few have reduced fees or improved services to better compete.

Grassroots® Research interviews with financial advisors in the US revealed that slightly less than two-thirds were somewhat familiar with robo-advisers, while slightly less than one-fourth were very familiar, and a few were not familiar. However, almost all sources said their clients are not interested in using robo-advisors/automated investment services for some or all investments, while a few said clients are somewhat interested.

Indeed, most sources have not noticed any impact from robo-advisors on their business, while a few have not personally noticed an impact but expect to in the future, and a few already have noticed an impact in various ways. Looking ahead, most do not expect they will make changes to deal with robo-advisors, because they do not view them as competition, while a few have made various changes, including fee reduction, unbundling of services and better explanations of their fee structure to clients.

Meanwhile, most sources have not had direct experience using robo-advisors for themselves or their clients, while a few have. In addition, almost all said they have not had clients use robo-advisors and then switch back, while a few have. Most sources have not noticed any reduced willingness among clients to pay for a personal financial advisor due to the increasing availability of free online information for personal investing, while a few have or expect to in the future.

Grassroots® Research is a division of Allianz Global Investors that commissions investigative market research for asset-management professionals. Research data used to generate Grassroots® Research reports are received from independent, third-party contractors who supply research that, subject to applicable laws and regulations, may be paid for by commissions generated by trades executed on behalf of clients.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Bond prices will normally decline as interest rates rise. The impact may be greater with longer-duration bonds. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted. This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG, licensed by FINMA (www.finma.ch) for distribution and by OAKBV (Oberaufsichtskommission berufliche Vorsorge) for asset management related to occupational pensions in Switzerland; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

758444

Samenvatting

A relatively new metric called the financial cycle can help tell investors more about an economy’s medium-term strength than the business cycle. The financial cycle can illuminate risks worth taking or avoiding, helping investors be more selective and active at a time when passively accepting risk may be detrimental.

Key takeaways

|