Mineral commodities primer: Copper

Copper is one of the most widely extracted metals, with only iron and aluminium being produced in greater quantities. The attractiveness of copper lies largely in its excellent conductive properties, both thermal and electrical, as well as its antimicrobial properties.

Key takeaways:

- Global trends point to strong growth in copper demand over the coming years.

- Copper indispensable for the decarbonization of energy production and transport.

- Long project lead times and ESG scrutiny will dampen supply growth.

- Prices likely to be well supported for the foreseeable future.

Indeed, copper has a broad range of uses that include electronics, plumbing, jewellery and coin production, as well as medical applications. And it is for these reasons, in particular, that we see the usage of copper growing in many areas of economic and daily life – energy infrastructure, transport, and consumer electronics are just three key growth areas where copper is indispensable and often irreplaceable.

Combined with the lack of viable substitutes for many applications, several global megatrends mean that copper demand is likely to continue growing steadily for many years to come. Critical here are ongoing efforts to decarbonize energy production, as well as passenger and freight transport. For example, wind and solar energy production requires around 2.5 times the copper per megawatt (MW) output than thermal generation,1 while the average battery electric vehicle (EV) uses around four times as much copper as an equivalent vehicle powered by an internal combustion engine.2

Industry overview

Copper extraction typically takes place in large scale mines using industrial techniques, meaning that new projects can have long lead-in times, require considerable capex commitments, and often raise complex ESG issues involving both effects on the natural environment and on local communities in the areas where extraction takes place. Mining is generally conducted using open pits; while the number of underground operations is growing, the economics of extraction dictate that these require higher ore grades – or the existence of valuable by-products – to be viable.

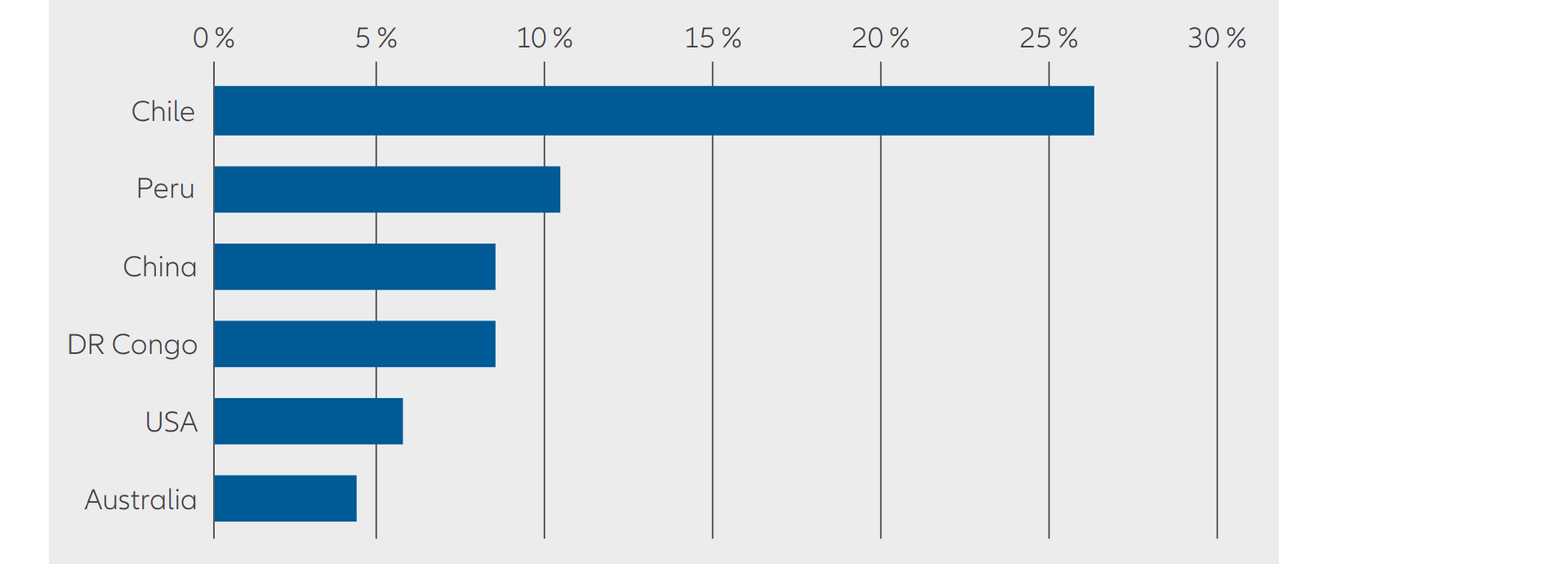

Geographically, copper production is currently concentrated in Chile (5.6 million metric tons in 2021, representing 27% of global production), Peru (2.2m tons; 10%), China (1.8m tons; 9%), DR Congo (1.8m tons; 9%), and the USA (1.2m tons; 6%).3 In corporate terms, the copper extraction industry is consolidated with several major players controlling a significant share of the market. For instance, the top five players in 2020 produced 6.28 million metric tons between them, or around 30% of total global production.4

In terms of copper smelting – the metallurgical process used to produce copper metal from unprocessed ores or copper scrap – China is dominant, with at least six of the world’s largest 20 smelters and over 50% of world copper smelter production in 2020;5 a reflection of China’s huge and growing demand for the metal, currently totalling over 50% of total global consumption.6 As with the extraction of copper ore itself, the smelting and refining process must also reckon with its own environmental footprint, with key issues including the management of off-gases and dust, as well as the energy-intensive nature of the smelting process.

Percentage share of global production

Source: U.S. Geological Survey, Mineral Commodity Summaries,January 2022

Supply, demand, and price outlook

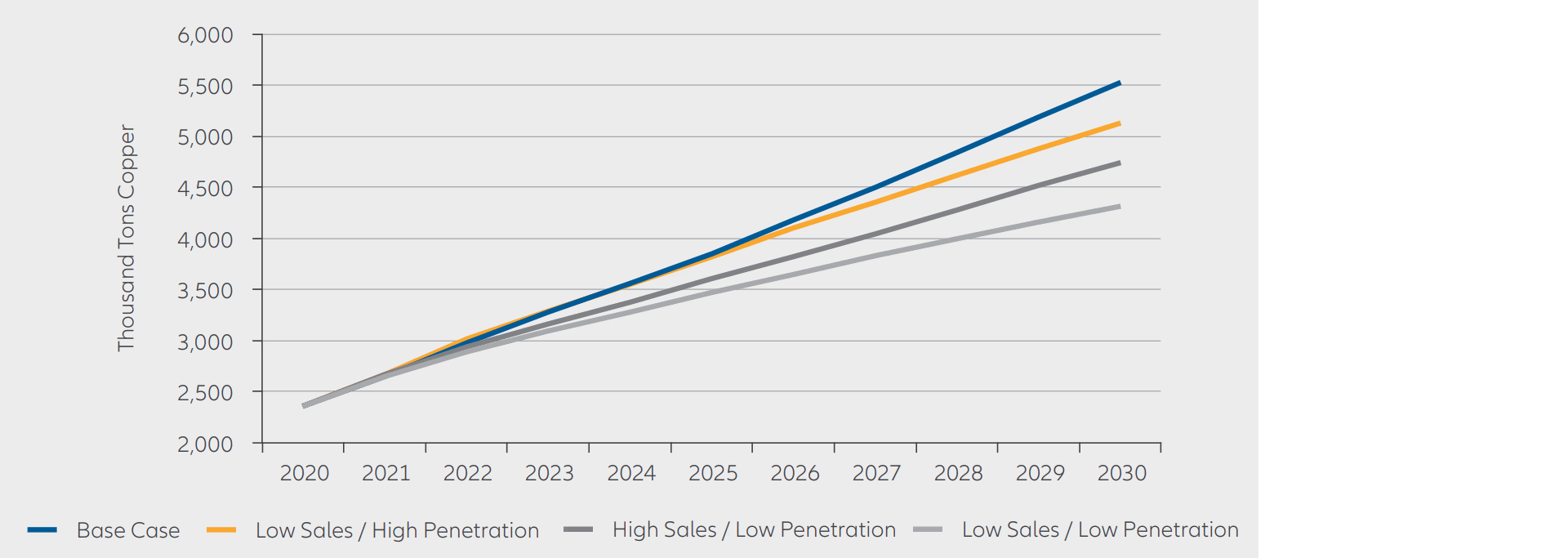

Decarbonization represents one of the most profound trends currently affecting economies throughout the world. With the switch to sustainable energy production and away from the internal combustion engine both crucial elements of achieving the Paris climate goals, copper’s growing role cannot be understated. To put it simply, there can be “no decarbonization without copper”.7 The move to net zero is thus currently a core driver of the structural bull market in commodities and copper in particular is likely to see surging demand as the transition accelerates. Indeed, by some estimates global copper demand is projected to grow, in a baseline case, by around 600% by 2030 and perhaps by up to 900% in the event that the adoption of green technologies picks up significant pace8 – something that seems increasingly likely given the ongoing uncertainty around energy supplies caused by the Russian invasion of Ukraine. Either way, the current decade is very likely to see the strongest growth in global copper demand on record and this growth may continue to accelerate as structural limitations on the expansion of renewable power generation and EV production are removed.9

EV copper demand scenarios

Source: Bloomberg

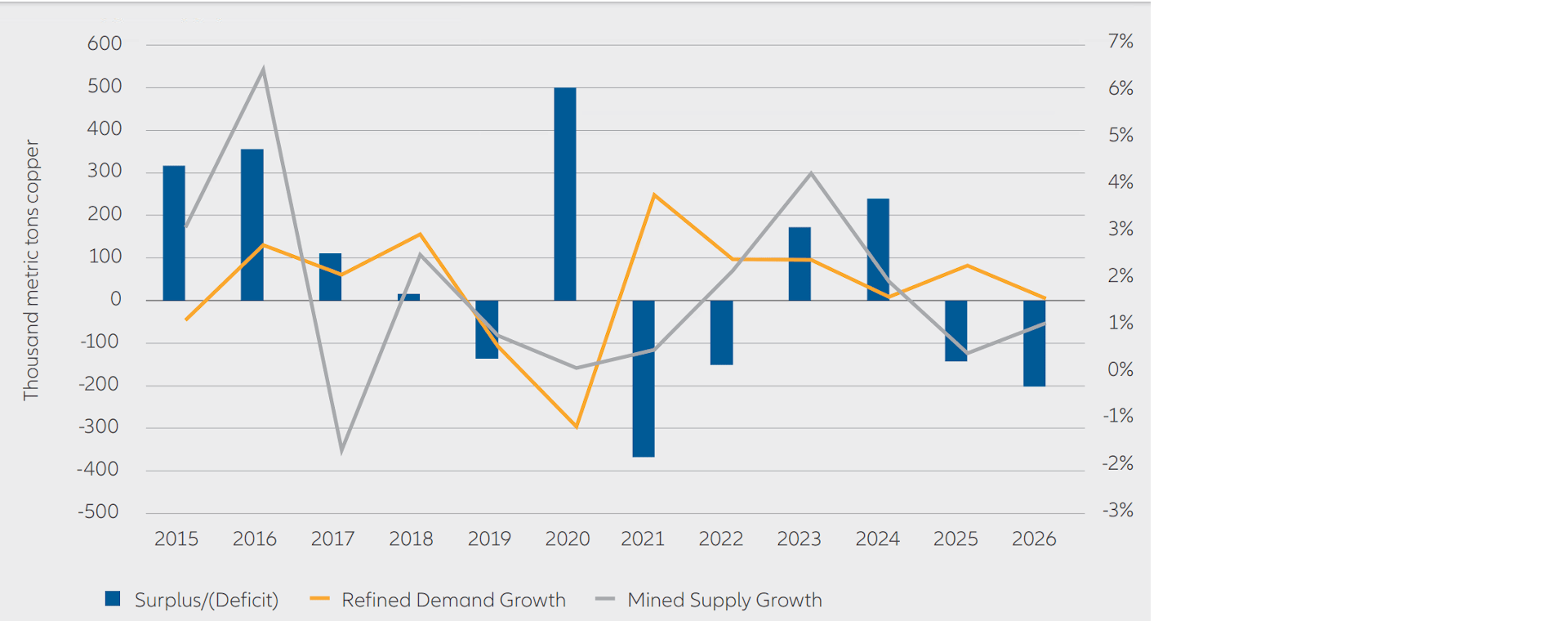

Copper supply and demand outlook