Allianz Strategic Bond

A globally diverse and flexible investment strategy that seeks out the best possible opportunities within the fixed income space across four key areas: duration/curve, credit, inflation and currencies.

The strategy targets a low correlation to equities, aiming to perform the role of a true portfolio diversifier, therefore offering protection in down markets and enhancing a portfolio’s overall risk adjusted return.

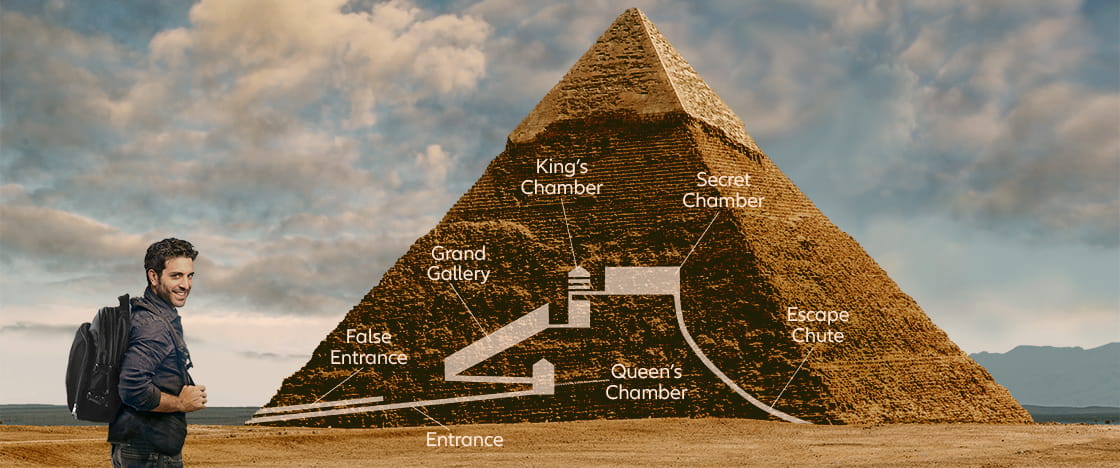

Click on the highlighted hotspots to enter the chambers. Begin your journey at the Queen's Chamber.

|

24/08/2020

|

||

|

24/08/2020

|

||

|

24/08/2020

|

||

|

24/08/2020

|

Portfolio Managers

Mike joined Allianz Global Investors in 2015 as a senior portfolio manager, with nearly 17 years of experience in fixed income. At AllianzGI, his responsibility lies across a portfolio of fixed income products - he is the lead manager for the Allianz Gilt Yield and Allianz Index-Linked Gilt strategies, co-manager for the Allianz Strategic Bond strategy and deputy manager for Allianz Fixed Income Macro strategy.

Prior to joining AllianzGI, Mike worked with M&G in London for 12 years running bond portfolios, and prior to that at Premier Asset Management. As well as depth of experience, Mike´s experience has breadth, including not only UK Bonds but also emerging markets and global mandates. Mike graduated from Birmingham University in 2001 with a BSc (Hons) in Money, Banking and Finance.

Kacper is a Global Macro Portfolio Manager based in London, having joined the firm in 2016. He focuses on rates and FX across developed and emerging markets, and has particular expertise in derivatives and options. At AllianzGI, Kacper is responsible for four strategies: he is the lead manager of Allianz Fixed Income Macro, co-lead of Allianz Strategic Bond strategy and deputy on two UK based government bond strategies, Allianz Gilt Yield and Allianz Index Linked Gilt.

Prior to joining AllianzGI, he held roles in London, Dubai and New York at Royal Bank of Scotland, National Bank of Fujairah and Bluecrest Capital Management. Kacper received a BSc (Hons) in Mathematics and Economics from the London School of Economics in 2008 and graduated with an MBA from Yale School of Management in 2016.

Jack is an Associate portfolio manager on the UK Fixed Income team, where he conducts global macro research and screens for relative value opportunities. Jack also serves as a product specialist for the team.

Having previously interned at Allianz Global Investors in Hong Kong and at Jupiter Asset Management in London, Jack joined the team at Allianz Global Investors in July 2016.

Jack holds a First Class Honours BSc in International Relations and an MSc with Merit in International Political Economy from the London School of Economics. He has passed his CFA level 3 exam.

1. Data as at 29th August 2020. A ranking, a rating or an award provides no indicator of future performance and is not constant over time.

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. Investing in fixed income instruments may expose investors to various risks, including but not limited to creditworthiness, interest rate, liquidity and restricted flexibility risks. Changes to the economic environment and market conditions may affect these risks, resulting in an adverse effect to the value of the investment. During periods of rising nominal interest rates, the values of fixed income instruments (including short positions with respect to fixed income instruments) are generally expected to decline. Conversely, during periods of declining interest rates, the values of these instruments are generally expected to rise. Liquidity risk may possibly delay or prevent account withdrawals or redemptions. Allianz Strategic Bond is a sub-fund of Allianz Global Investors Fund SICAV, an open-ended investment company with variable share capital organised under the laws of Luxembourg. The value of the units/shares which belong to the Unit/Share Classes of the Sub-Fund that are not denominated in the base currency may be subject to an increased volatility. The volatility of other Unit/Share Classes may be different and possibly higher. Past performance is not a reliable indicator of future results.

If the currency in which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency. This is for information only and not to be construed as a solicitation or an invitation to make an offer, to conclude a contract, or to buy or sell any securities. The products or securities described herein may not be available for sale in all jurisdictions or to certain categories of investors. This is for distribution only as permitted by applicable law and in particular not available to residents and/or nationals of the USA. The investment opportunities described herein do not take into account the specific investment objectives, financial situation, knowledge, experience or specific needs of any particular person and are not guaranteed. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer companies at the time of publication. The data used is derived from various sources, and assumed to be correct and reliable at the time of publication.

The conditions of any underlying offer or contract that may have been, or will be, made or concluded, shall prevail. The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors GmbH.

For professional investors in Europe (excluding Switzerland)

For a free copy of the sales prospectus, incorporation documents, daily fund prices, key investor information, latest annual and semi-annual financial reports, contact the management company Allianz Global Investors GmbH in the fund’s country of domicile, Luxembourg, or the issuer at the address indicated below or www.allianzgiregulatory.eu. Austrian investors may also contact the Austrian information agent Allianz Investmentbank AG, Hietzinger Kai 101-105, A-1130 Vienna. Please read these documents, which are solely binding, carefully before investing. This is a marketing communication issued by Allianz Global Investors GmbH, www.allianzgi.com, an investment company with limited liability, incorporated in Germany, with its registered office at Bockenheimer Landstrasse 42-44, 60323 Frankfurt/M, registered with the local court Frankfurt/M under HRB 9340, authorised by Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de). Allianz Global Investors GmbH has established branches in the United Kingdom, France, Italy, Spain, Luxembourg, Sweden, Belgium and the Netherlands. Contact details and information on the local regulation are available here (www.allianzgi.com/Info).

For qualified investors in Switzerland

For a free copy of the sales prospectus, incorporation documents, daily fund prices, key investor information, latest annual and semi-annual financial reports, contact the management company Allianz Global Investors GmbH in the fund’s country of domicile, Luxembourg, the Swiss funds’ representative and paying agent BNP Paribas Securities Services, Paris, Zurich branch, Selnaustrasse 16, CH-8002 Zürich or the editor either electronically or by mail at the given address or www.allianzgi-regulatory.eu. Please read these documents, which are solely binding, carefully before investing. This is a marketing communication issued by Allianz Global Investors (Schweiz) AG, a 100% subsidiary of Allianz Global Investors GmbH.