Résumé

To help guide investors through the Ukraine-Russia conflict, we analysed more than a dozen similar events since 1953. Our conclusion? Underlying economic factors tend to be bigger drivers of the markets than geopolitical events – so keep a close eye on the oil price, inflation and central bank actions.

Key takeaways

|

In times like these, some investors rely on an old market adage: “buy on the sound of cannons, sell on the sound of trumpets”1. But is that really a good idea? To find out, we analysed the connection between geopolitical crises and financial markets, rounding up more than a dozen moments in the not-too-distant past that have parallels with the current situation. (See below for a list.)

How markets have responded to 13 recent crises

In our analysis, we found no way to draw clear conclusions about the effect of global crises on stocks, bonds, commodities or currencies. There have been times when markets have bounced back emphatically, and times when they haven’t.2

- Notable bull markets after crisis. After the two Iraq wars, for instance, the markets performed quite well. But we think there were more significant drivers of these rebounds – notably the imminent end of a recession (1991) or the bounce-back from the tech bubble (2002-2003).

- Notable post-crisis drops. Markets were under massive pressure after Russia’s invasion of Georgia in 2008 – but this was likely a result of the global financial crisis, not the political crisis.

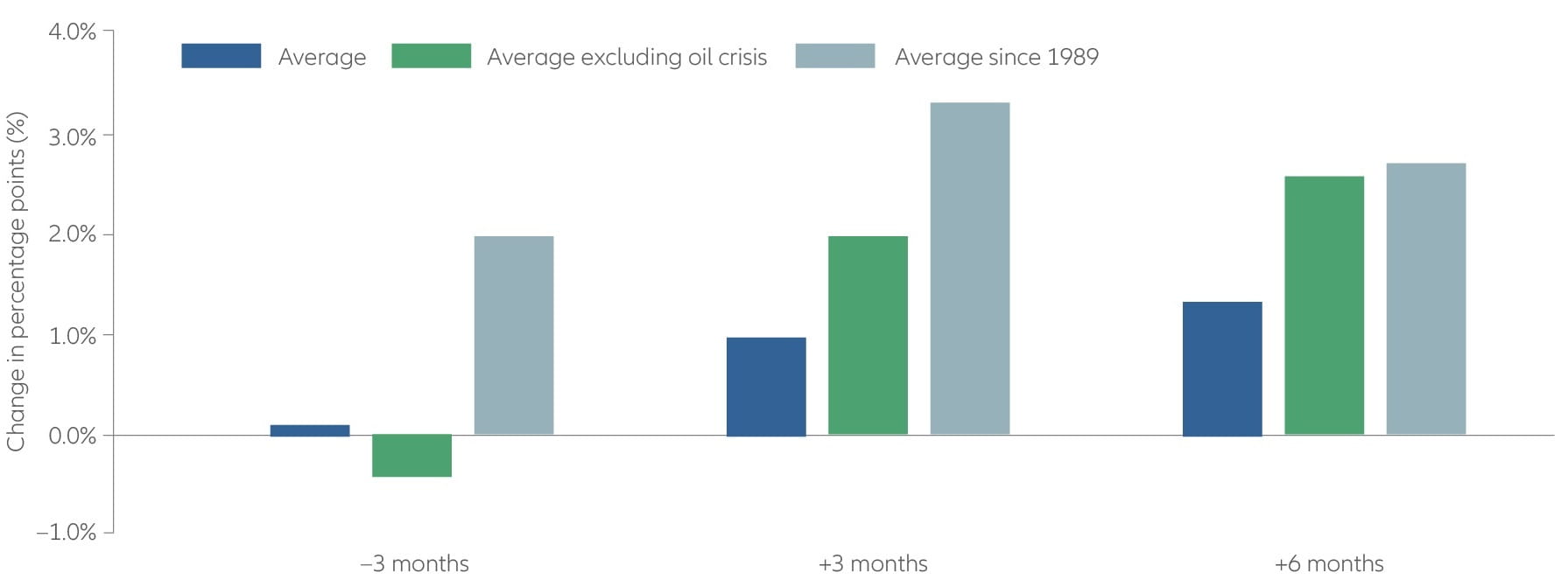

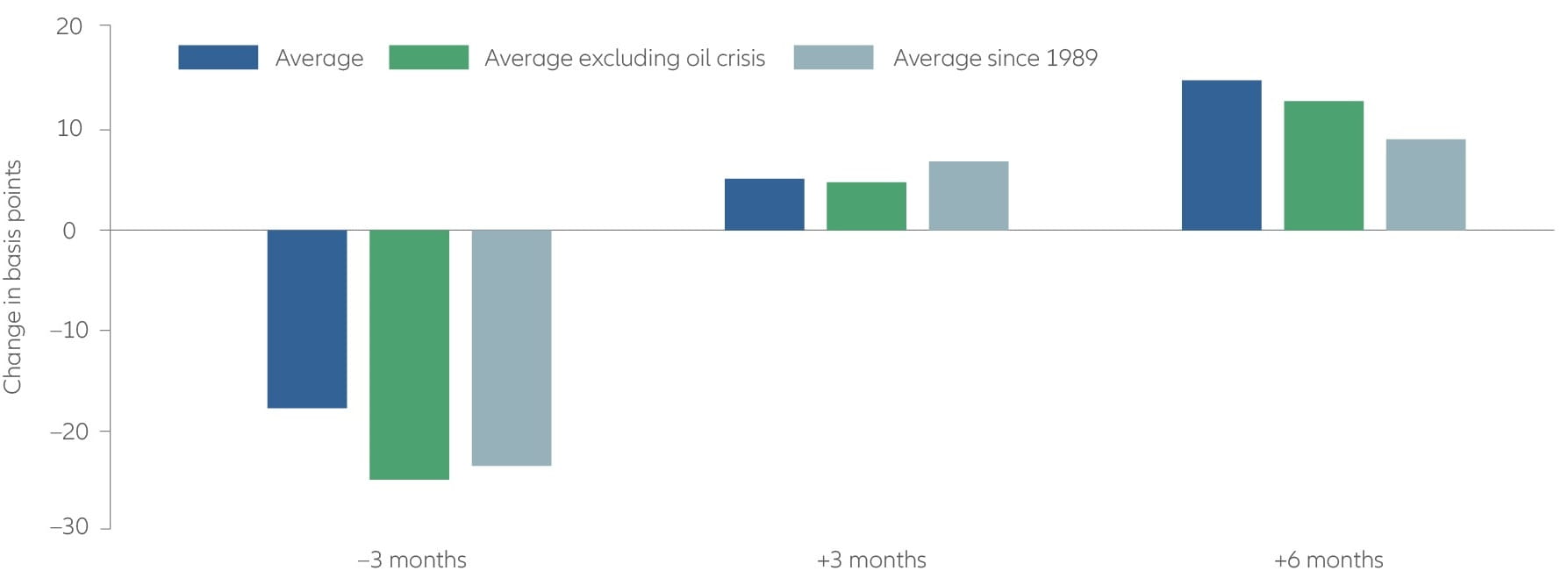

On many other occasions, the equity market moves were non-spectacular. Overall, and as the charts below show, stocks have – on average – tended to do somewhat better after the onset of global crises. At the same time, “safe” assets such as US Treasuries have – on average – historically sold off slightly, causing their yields to rise. But as we explained in the examples above, non-crisis-related factors were likely the bigger drivers of performance. This is the important conclusion we draw from the past, and it does not support the idea of “buying on the sound of cannons”. Rather, investors should make their decisions to buy or sell based on the health of the overall economy and the outlook for industries and earnings.

Stocks have tended to rebound after global crises – particularly after the Cold War ended

S&P 500 Index performance (in %) during 13 crisis periods (see list below)

Post-crisis yields have tended to rise as investors moved away from “safe” assets

10-year Treasury performance (in basis points) during 13 crisis periods (see list below)

Source for both charts: Allianz Global Investors, Refinitiv Datastream, GFD. Calculations based on market developments around GDR (17/3/1953); Hungary (28/10/1956); Cuban crisis (10/10/1962); Czechoslovakia (21/8/1968); Poland (13/12/1981); oil crisis 1 (6/10/1973); oil crisis 2 (16/1/1979); Iraq war 1 (17/1/1991); Iraq war 2 (19/3/2003); Arab Spring in Tunisia (17/10/2010); Georgia (1/8/2008); Crimea/Ukraine (3/3/2014); US-North Korea (8/8/2017). Past performance is not indicative of future results.

How the markets are reacting to the crisis in Ukraine

Since the Ukraine conflict started, we haven’t seen signs of outright panic – at least in the main markets. The so-called “fear index” – the volatility index, or VIX – is currently at about 35. This is well above its long-term average of about 20, but far from the extreme values (50+) seen in recent years. The reality is that despite how volatile markets may make investors feel, price movements have been relatively restrained since the outbreak of Ukraine-Russia hostilities. It is true that the S&P 500 has lost more than 10% of its value from its peak earlier in the year, but US equity valuations are still quite high when viewed in a historical context. Moreover, the decline in European stock markets has been less dramatic, while emerging markets – excluding Russia, of course – have not changed much.

Oil prices are another story. There has been a significant rise in energy prices, with both West Texas Intermediate (WTI) and Brent crude trading above USD 100 – twice as high as two years ago. This is likely to leave its mark on economic growth. In the past, a doubling of the oil price within two years has repeatedly led to a recession.

Against this backdrop, it is fair to wonder if central banks, especially the US Federal Reserve, will postpone or even stop the announced normalisation of monetary policy. We doubt it, in large part because of the inflation outlook. Consider that the rise in the price of oil will likely lead to higher inflation rates than previously expected. Moreover, companies and households may continue to raise their inflation expectations in light of higher energy prices– which can actually push inflation up further. Since the end of 2021, central banks have been increasingly pointing to underlying inflationary pressures and tight labour markets. Our analyses show that while we can expect a decline in the annual change in inflation rates, inflation is very likely to remain above the Western central banks' target of 2% in the medium term.

Plus, the Fed regularly points out that it wants to tighten general financial conditions, not just central bank interest rates. A gradual decline in stock prices or an increase in market interest rates for loans and corporate bonds is unlikely to change that.

Against this backdrop, we remain cautious on equities for the time being. The markets have enjoyed years of solid performance, and the Ukraine crisis may spur additional selloffs over the coming weeks.

Here are the 13 market-moving crises that we analysed

| Cold war | 1981 | Martial law in Poland |

| 1968 | Invasion of Czechoslovakia | |

| 1962 | Cuban Missile Crisis | |

| 1956 | Invasion of Hungary | |

| 1953 | East Germany (GDR) uprising | |

| Oil crisis | 1979 | Oil shock after Iranian revolution |

| 1973 | OPEC oil embargo | |

| Gulf wars | 2003 | Second US-Iraq war |

| 1991 | First US-Iraq war | |

| Arab spring | 2011 | Middle East uprisings |

| Russian military action | 2014 | Crimean crisis (Ukraine) |

| 2008 | Invasion of Georgia | |

| North Korea aggression | 2017 | US-North Korea tensions |

1 This quote is frequently attributed to London financier Nathan Rothschild, 1810.

2 Source: AllianzGI research, Refinitiv Datastream. S&P 500 returns after the start of the first Iraq war (17 January 1991) were 19.0% for the 3-month period and 16.2% for the 6-month period. S&P 500 returns after the start of the second Iraq war (19 March 2003) were 13.8% for the 3-month period and 18.6% for the 6-month period. Past performance is not indicative of future results.

The S&P 500 Index is an unmanaged index generally considered representative of the US stockmarket. Investors cannot invest directly in an index.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Equities have tended to be volatile, and do not offer a fixed rate of return. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bond prices will normally decline as interest rates rise. The impact may be greater with longer-duration bonds. Emerging markets may be more volatile, less liquid, less transparent, and subject to less oversight, and values may fluctuate with currency exchange rates. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; ; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; and in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

2058425

Résumé

The invasion of Ukraine has shaken financial markets, which were already navigating inflation and central bank monetary tightening risks. Investors should remain cautious yet prepared for investment opportunities that may arise.

Key takeaways

|