Navigating Rates

Twists in Middle East conflict pose renewed oil market risk

Tensions in the Middle East have escalated further with US and UK air strikes against Houthi rebels and Iran’s seizing of an oil tanker. We think oil is set to be the main transmission channel of the conflict to markets. We’re watchful about the risk to oil prices, trade, and inflation.

Key takeaways

- Oil prices gained in the aftermath of the launch of air strikes by the US and UK and have the potential to surge further, particularly in the event of a worse-case scenario of a closure of the Strait of Hormuz.

- But we think global economic developments are likely to be the main driver of oil in the near-term, with broader financial markets also remaining more preoccupied with the path of interest rates and the extent of slowing growth in the US, Europe and China.

- The rerouting of ships from the Red Sea poses a risk to global commerce and as supply chains and payment terms lengthen, businesses may require more working capital, potentially increasing demand for trade finance.

The launch of air strikes by the US and UK against Yemen-based militants represents a dramatic escalation in the three-month long Middle East conflict. The strikes come in retaliation to attacks by Iran-backed Houthi rebels on commercial ships in the Red Sea that have caused weeks of disruption in one of the world’s busiest shipping lanes. US President Joe Biden said the military action was aimed at protecting the flow of international commerce.1 The Houthis have vowed to continue targeting shipping in response to Israel's war in Gaza and on 15 January attacked a US-owned cargo ship in the Gulf of Aden.2

Threat to oil prices

We think oil is likely to be the main direct transmission channel of the conflict to markets (as it was in the immediate aftermath of the Israel-Hamas conflict). On 12 January, oil prices rose 4% to above USD 80 a barrel for the first time in 2024 and we see the potential for further gains if military action increases further. The latest spike in the oil price comes after the International Association of Independent Tanker Owners (INTERTANKO), the world’s largest tanker body, advised its members to avoid the waters off Yemen, warning the threat to shipping could last for several days.3 In our view, the main worry for markets and the biggest catalyst for oil prices is if conflict spreads to the Strait of Hormuz, the narrow stretch of water between Oman and Iran through which around a fifth of the volume of the world's total oil consumption passes every day (see Exhibit 1). That risk came into focus on 11 January when Iran seized St Nikolas, a tanker carrying Iraqi oil, off the coast of Oman, not far from the strait.4

Iran’s seizure of the St Nikolas demonstrates a further threat to shipping and oil prices. In the near-term, we think oil is likely to remain range-bound, with a weak Chinese economy and fears of a global recession offsetting incremental geopolitical risk in the Middle East and the need to refill oil inventories. Oil remains a good hedge against geopolitical tensions and inflation. Oil prices are vulnerable to political turmoil headline risk and further unrest, particularly focused around the Strait of Hormuz, could stoke price rises. In the worst-case scenario of a closure of the strait, Goldman Sachs estimates prices would rise 20% in the first month of the interruption and potentially double if the closure is prolonged.5 Markets currently price a probability of less than 0.5% of a closure happening, according to Goldman Sachs.6 Indeed, the strait has never been closed, despite many threats throughout recorded history. Although we agree the probability of a closure is low, we think markets may be too sanguine given the unpredictability posed by local militias holding high-precision missiles.

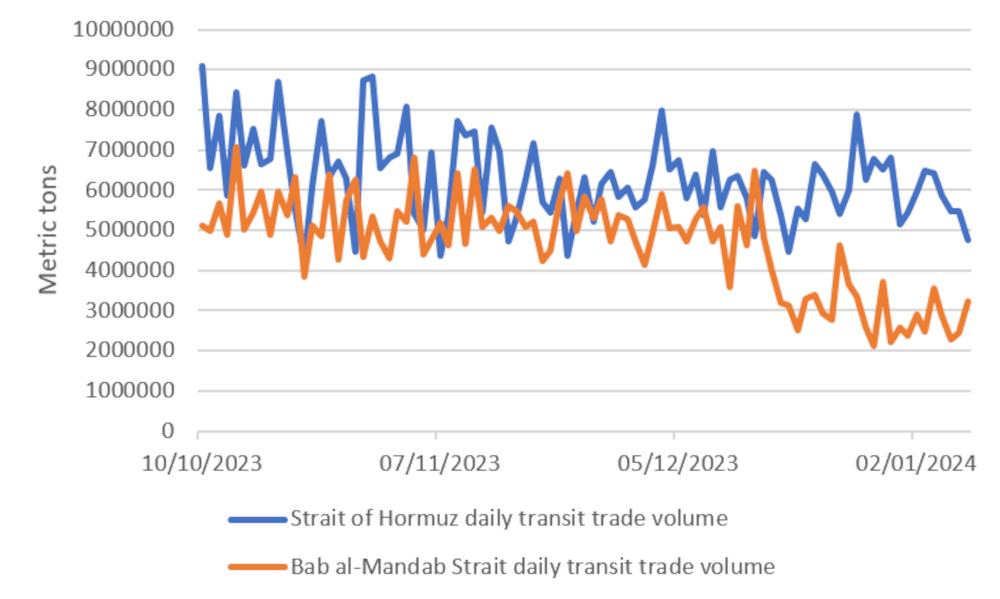

Exhibit 1: Trade through the Strait of Hormuz has been little affected compared to the Bab al-Mandab Strait on the other side of the Arabian Peninsula

Sources: Global Platform; PortWatch. Data as at 8 January 2024.

Broader market focus: interest rates and growth

Still, we think broader financial markets may remain more preoccupied with macroeconomic developments. Equity and fixed income markets have been laser-focused on the path of interest rates and the extent of slowing growth in the US, Europe and China. We don’t see signs of that changing unless the conflict takes an even more dramatic turn – such as direct military engagement between the US and Iran – which is certainly not our base case scenario. This is not the first time Iran has seized a foreign oil tanker7 and also not the first time the US has played a role in military action against the Houthis (in 2015, it supported a Saudi Arabia-led coalition fighting the Houthis). None of those earlier episodes triggered significant market movements. We expect markets to be similarly calm now, despite the backdrop of the Israel-Gaza conflict. But we caution that tensions are high and the risks of the conflict spiralling further are heightened.

Avoiding wider conflict

So, what do we think could happen next? Even as the US and its allies continue the air strikes, we still think international powers will be at pains to avoid fanning a wider conflict that would be in nobody’s interests. The US and its European partners don’t want to be embroiled in a local conflict, especially with President Biden entering an election year. Iran is contending with domestic issues (from runaway inflation to political dissent) and is deterred from taking military action by the US’s military assets in the region. China favours a status-quo situation. As the largest buyer of (cheap) Iranian oil, it is focused on supporting a weak domestic economy. Oil producers in the Arabian Gulf took steps to improve relations with Israel and Iran before the Gaza war. And while they might receive higher revenues if oil prices surged in response to greater conflict, any upside would be outweighed by a bleaker geopolitical outlook in the region.

We think the US and Europe will continue to make a diplomatic push to stop spillover from the Gazan war into Israeli-occupied West Bank, Lebanon and Red Sea shipping lanes. We expect the US to continue to try to dissuade Israel from a broader war with Lebanese militant group Hezbollah, another Iran proxy, while possibly seeking to mediate talks on drawing the land border between Israel and Lebanon.

Shipment delays could fan inflationary pressures

The conflict continues to pose a risk to global commerce. Since November, many cargo shipping firms have been rerouting vessels away from the Suez Canal route – through which around a third of global container ship cargo flows – with the result of possible delays in shipments and higher costs for businesses and ultimately consumers. As supply chains and payment terms lengthen, businesses may require more working capital. For investors in trade finance, that may increase opportunities and potentially improve returns.

Global inflationary pressures may be exacerbated If oil prices spike because of an escalation. Such a scenario may require central banks to rethink their monetary policy paths, increasing the likelihood of interest rates in major economies such as the US and Europe remaining higher for longer.

While markets may continue to focus on the health of the global economy, further twists in the Middle East crisis could, however, make it a much bigger focal point for investors.

1 Source: Statement from President Joe Biden on Coalition Strikes in Houthi-Controlled Areas in Yemen, The White House, 11 January 2024

2 Source: Houthi rebels hit US-owned cargo ship in Gulf of Aden, Financial Times, 16 January 2024

3 Source: Combined Maritime Forces warns ships to avoid Bab al-Mandab Strait – INTERTANKO, Reuters, 12 January 2024

4 Source: Iran seizes oil tanker St Nikolas near Oman, BBC News, 11 January 2024

5 Source: Goldman Sachs, December 18 2023

6 Source: Goldman Sachs, December 18 2023

7 Source: Iran seizes two Greek tankers amid row over U.S oil grab, Reuters, 27 May 2022